The word “budget” often feels heavy, doesn’t it? It conjures up images of cutting expenses, saying no to fun, and living a life defined by financial restriction. This scarcity-focused view is why so many people fail at budgeting—they see it as a painful chore that only poor people have to do. Yet, if you look at genuinely wealthy people, from entrepreneurs managing multi-million-dollar ventures to disciplined investors, they operate with meticulous financial plans. The key difference is this: The rich don’t budget to restrict; they budget to allocate. They see a budget not as a fence, but as a blueprint for funding their most abundant life.

Imagine your current financial life is a river flowing randomly, occasionally flooding your bills and leaving your savings dry. Now visualize a life of financial abundance: your money flows through a series of clear, intentional channels, each leading to a desired outcome. That’s what allocation is. It’s the difference between blindly hoping you’ll have money left over and intentionally directing every dollar to a specific job—a job that aligns with your biggest goals. When you allocate, your future isn’t a vague dream; it’s a line item in your plan. You’re not saying, “I can’t buy this coffee”; you’re saying, “I am choosing to put this coffee money toward my three-month travel fund.” This is the empowering language of abundance.

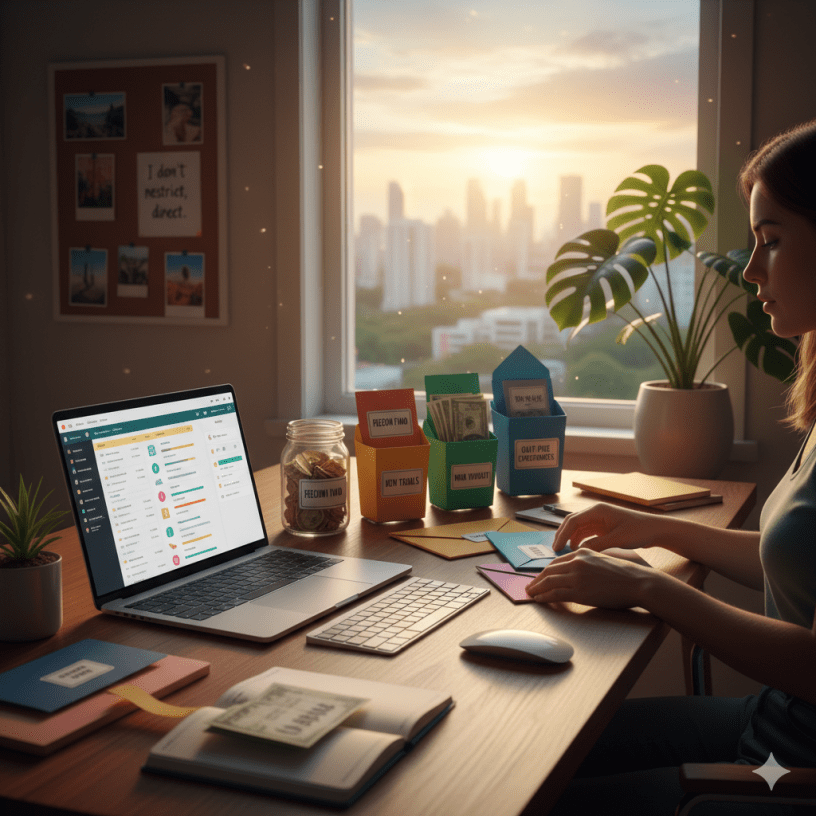

Let’s look at two contrasting spending approaches. The Scarcity Saver sees $500 extra at the end of the month and immediately puts it into a savings account with a vague instruction: “Don’t touch this.” This lack of purpose makes the money feel available for emotional spending, and it’s often raided when a new gadget comes out. Now, look at The Abundant Allocator. They use that same $500 and divide it with purpose: $250 goes to “Future House Down Payment,” $150 goes to “Aggressive Index Fund Investing,” and $100 goes to the “Guilt-Free Experiences” fund. When they spend the $100, they do so with joy, knowing the other funds are safe and dedicated to their highest purpose.

This intentional allocation is the reason the abundant thinker can enjoy a higher quality of life without guilt. They define their values first. If travel is paramount, they allocate a higher percentage to their “Travel Bucket.” If early retirement is the mission, they allocate a higher percentage to investing. This framework provides clarity and peace. You stop fighting with yourself about money because the decision has already been made. If the money isn’t in the “Fun” category, it doesn’t get spent, because that money is already working hard to buy you future freedom. It gives you permission to say, “Yes, I will buy this expensive, healthy food because my budget allocated for my health.”

The abundant mindset uses the budget to maximize happiness per dollar, not minimize cost per dollar. It focuses on the return on happiness. To start allocating like the rich, stop tracking what you did spend and start telling your money where to go before you spend it. Create “buckets” for your future—Retirement, Travel, New Car, Skill Development. Then, when your paycheck arrives, be the CEO of your money and assign every dollar to a purpose. You are not sacrificing your present; you are commissioning your present money to build your future life. This simple act of giving every dollar a job is the most powerful tool for turning a life of financial strain into a life of guaranteed abundance.

Begin today by naming your saving accounts not by numbers (Account 1, Account 2) but by purpose (Freedom Fund, New Skills Investment, Dream Vacation). This small change will transform your money from a problem you manage into a powerful team of employees working toward your abundant, allocated goals.