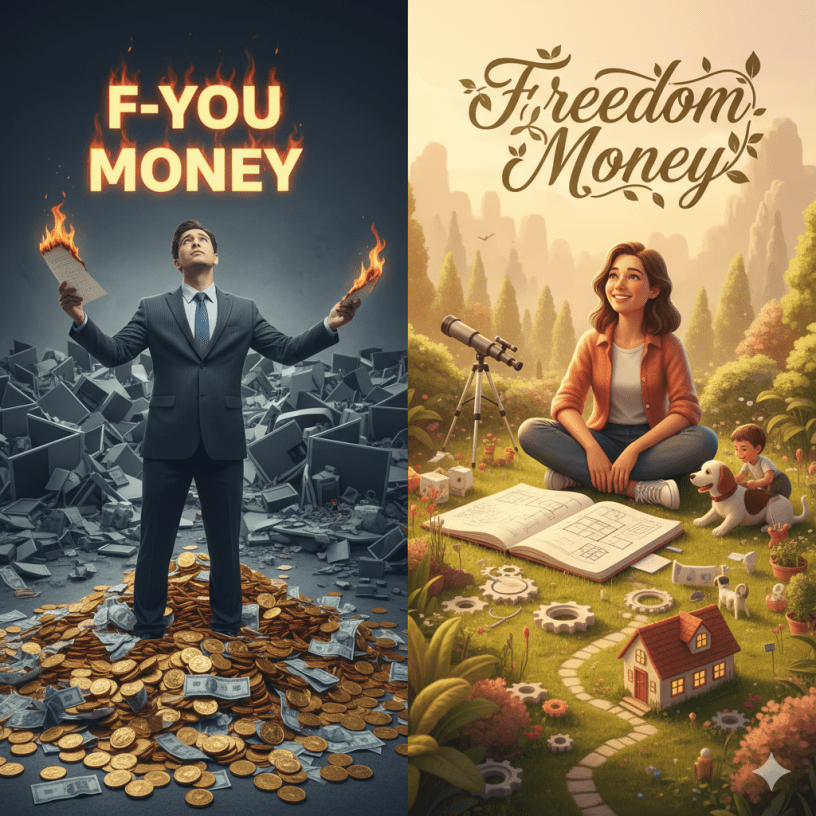

When people first get serious about financial independence, they usually latch onto the concept of “F-You Money.” It’s an alluring, primal goal: having enough cash to walk away from any job, any bad boss, or any situation you hate, simply because you don’t need the paycheck. It promises power, revenge, and instant relief. But imagine achieving it. You’ve walked out, slammed the door, and that initial rush fades. Now you’re sitting in your quiet home, financially secure, yet faced with a terrifying question: What now? Many who achieve this goal find that freedom from constraint is not the same thing as freedom for purpose. The former is just security; the latter is joy.

To truly live an abundant life, you need to shift your focus to “Freedom Money.” This concept starts not with a reaction to a bad job, but with a deep, deliberate answer to the question: What does my perfect, purpose-driven life cost? It’s about building a financial structure that fully funds your passion, your health, and your relationships—not just your bills. Think about the difference: F-You Money might let you quit your job, but Freedom Money lets you start the non-profit you’ve always dreamed of, or spend two extra hours every afternoon helping your kids with homework. It moves the conversation from running away from something to intentionally running toward something truly meaningful.

Let’s visualize this through a life example. Meet two friends, Alex and Ben, both aiming for a $1 million portfolio. Alex focused solely on F-You Money. They lived an extremely frugal, minimalist life, cutting out almost all joy and travel, obsessed with hitting that $1 million mark as fast as possible so they could quit their high-stress job in finance. They succeeded at age 35. But once free, Alex felt directionless, lacking the skills or energy for anything beyond their small apartment, and struggled to re-engage with hobbies they had sacrificed. Their life was debt-free, but joy-free.

Now, consider Ben, who chased Freedom Money. Ben defined their ideal life first: a low-travel job that paid enough, a big garden, two months a year dedicated to volunteering, and enough money to buy high-quality, healthy food. Ben’s target number was $800,000, not $1 million, because their ideal life was actually less expensive than Alex’s “quit everything” plan. Ben took longer to hit the goal, but every investment and lifestyle choice was a step toward a pre-defined, happy future. When Ben reached their number, they didn’t quit; they just dropped their hours to three days a week and started their passion project immediately. Ben’s journey was built with guilt-free spending on things that enhanced the future, like a certification course or a family trip.

The abundant life is one of holistic alignment. Chasing F-You Money is a sprint of painful deprivation; chasing Freedom Money is a marathon of intentional choices. It forces you to define your core values and ensures your money is a loyal servant to those values. If family time is your value, Freedom Money includes the cost of a housekeeper to free up your weekends. If creativity is your value, it funds the studio space and equipment. You stop viewing money as a shield against bad things and start seeing it as an accelerator for great things.

So, ask yourself: What are you really aiming for? Is it a life defined by the absence of work, or a life defined by the abundance of purpose? Your next financial move shouldn’t be about how to squeeze more pennies, but about how to invest in the life you would never want to quit. Take out a journal today and don’t write down your debt total—write down your perfect, ideal day, hour by hour. Then, calculate the money needed to make that day your reality. That new number is your true, joyful Freedom Money goal.